loan Products and Features

In light of shifting demands and in response to your feedback, we are delighted to introduce to you our loans products that will provide you the flexibility and choice in your financial journey. These have been developed to a range of options/flexibility in line with our promise of making it possible and Rising together.

All loans should be within three times your deposit contribution, Holiday advance loan is an exception which is tied to your holiday savings.

All loans except holiday advance should be guaranteed by shares.

Click on the product to view details

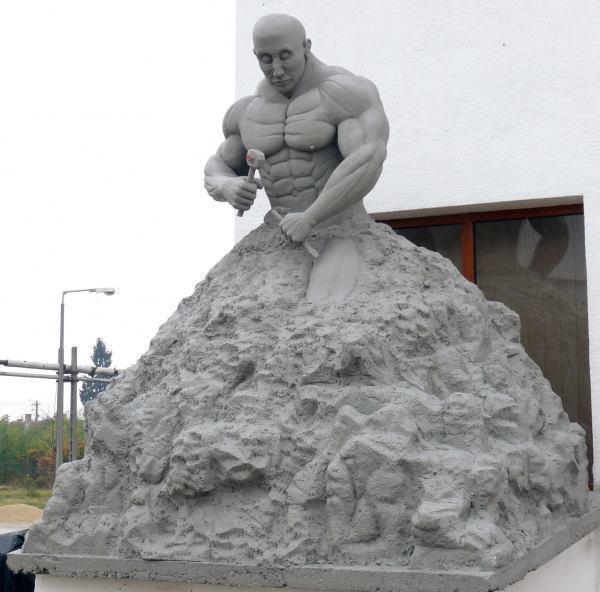

Jijenge Loan

2. Repayment tenure 60 months

3. Interest rate 1.25%/month on reducing balance

4. Loan processing fee 1% of loan amount, Maximum chargeable ksh 5,000

5. Top up after 6 months

6. Top up fee ksh 5,000

7. Minimum share capital ksh 50,000 can be deducted from loan issued.

8. Minimum share contribution going forward after the loan is issued ksh 5,000

Nyumbani Loan

2. Repayment tenure 48 months

3. Interest rate 1%/month on reducing balance

4. Loan processing fee 1% loan amount Maximum chargeable ksh 3,000

5. top ups eligible after 6 months repayment (Minimum take home 100,000)

6. Top ups before six months elapse attract a charge of ksh 2,000

7. Minimum share capital ksh 30,000

Wezesha Loan

2. Repayment tenure 12 months

3. Interest rate 2%/month on reducing balance

4. Loan processing fee ksh 1,000.

5. top ups eligible after six months repayment (Minimum take home 50,000)

6. Minimum share capital ksh 30,000

Karibu Loan

2. Repayment tenure 3 months

3. Interest rate 1.5%/month on reducing balance

4. Loan processing fee ksh 1,000.

5. No option for loan top up.

Okoa Salo Loan

a) Repayment term shall be one off.

b) Limit 50% of member net salary

c) Maximum amount up to total members share contribution.

d) The interest rate shall be 10 %

Holiday Advance

2. Second half of the year 12 times monthly holiday savings.

3. Maximum tenure 12 months

4. Interest rate 10 %/month on reducing balance

5. No loan processing fee

6. Top up eligible after one month

7. No top up fee

Masomo Superior Loan

2. Repayment tenure 12 months

3. Interest rate 1%/month on reducing balance

4. Loan processing fee ksh 1,000.

5. top ups eligible after 3 months repayment

6. Minimum share capital ksh 30,000

Dharura Loan

2. Maximum tenure 6 months

3. Interest rate 1.25 %/month on reducing balance

4. Loan processing ksh 1,000

5. Top up eligible after 3 months repayment

6. top up fee ksh 2,000

7. Share capital cap ksh 30,000

Bima Loan

2. Repayment tenure 6 months

3. Interest rate 2%/month on reducing balance

4. Loan processing fee ksh 1,000.

5. No top ups

6. Minimum share capital ksh 30,000